Stock Market Investing is one of the most powerful ways to build wealth over time, offering you the opportunity to create financial freedom and take control of your future.

Imagine waking up each morning with the freedom to do whatever you want—whether it’s sipping chai on your balcony, planning a vacation, or pursuing a long-delayed passion. Investing in the stock market can be the key to turning these dreams into reality, just like it did for me when I first began my journey.

I know the stock market can seem scary at first. But trust me, it’s not a gamble; it’s a calculated way to grow your wealth if you approach it wisely. I want to show you that this journey is possible for you. Let’s take that first step together and explore how the Indian stock market can be your ticket to financial freedom.

Stock Market Investing for Beginners: Key Steps to Begin Your Journey

Before jumping in, it’s essential to understand the basics. The Indian stock market is where companies sell shares, giving you the chance to become a part-owner. When companies grow, so does your investment.

The Importance of Stock Market Investing for Beginners

- It helps you build wealth over time.

- It allows businesses to grow and innovate.

- It provides a sense of financial security and independence.

I remember reading about investors like Rakesh Jhunjhunwala and Radhakishan Damani, who started with small investments and built massive fortunes. If they could do it, why can’t you?

Overcoming the Fear of Stock Market Investing

One of the biggest barriers to investing is fear. “What if I lose my money?”—I’ve thought that too. Let me share the story of Aman, a young professional who always wanted to invest but hesitated because of the fear of losing money. After months of self-doubt, he decided to start with a small amount and gradually learned the ropes. Over time, his confidence grew, and today, he has a solid portfolio.

How to Overcome Fear?

- Start small and take it slow.

- Learn from books, online resources, or mentors.

- Keep up with market trends.

- Understand that losses are part of the journey.

Every successful investor started somewhere. The key is to take that first step, no matter how small. The fear will fade with experience.

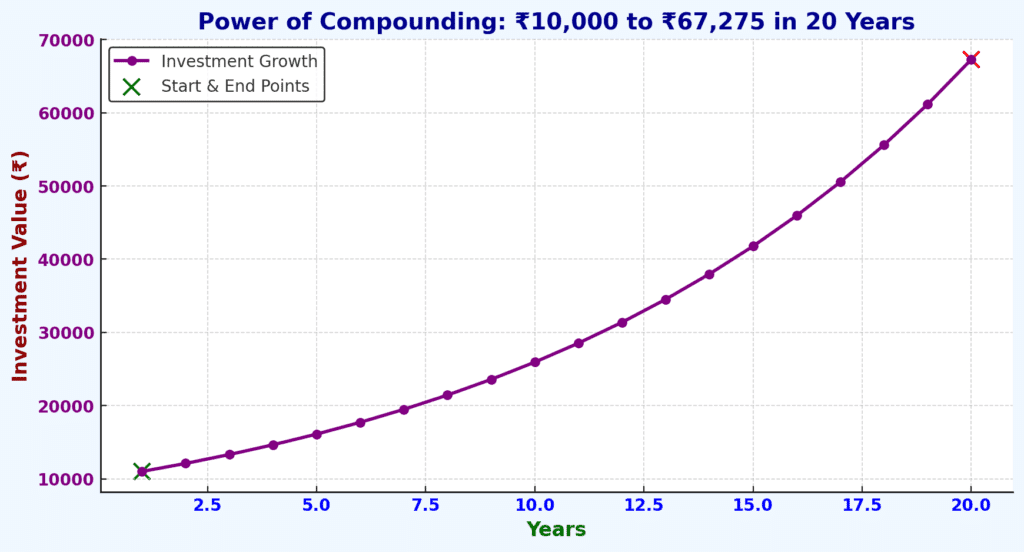

The Power of Compounding in Stock Market Investing for Beginners

Albert Einstein once said, “Compounding is the eighth wonder of the world.” It’s like planting a mango tree. At first, it’s just a small sapling, but with time and care, it grows into a strong tree that bears fruit every season—without extra effort. Similarly, your investments, when left to grow, can multiply over time.

Compounding Example: Let’s say you invest ₹10,000 in the stock market, and the investment earns an average return of 10% annually.

- Year 1:

- Investment: ₹10,000

- Annual return (10% of ₹10,000): ₹1,000

- Total value at the end of Year 1: ₹11,000

- Year 2:

- Investment: ₹11,000

- Annual return (10% of ₹11,000): ₹1,100

- Total value at the end of Year 2: ₹12,100

- Year 3:

- Investment: ₹12,100

- Annual return (10% of ₹12,100): ₹1,210

- Total value at the end of Year 3: ₹13,310

Now, let’s look at the impact of compounding over 20 years:

After 20 Years:

If you left your ₹10,000 investment to grow at a 10% return rate annually, it would grow to:

- Future Value = ₹10,000 × (1 + 0.10)^20

- Future Value = ₹10,000 × 6.7275

- Future Value = ₹67,275

Summary of the Example:

- Initial Investment: ₹10,000

- Annual Return: 10%

- Investment Duration: 20 years

- Final Amount: ₹67,275

In this example, the power of compounding helps your ₹10,000 grow six times over in 20 years without you adding any extra money! The interest you earn in Year 1 becomes part of your principal in Year 2, and this continues year after year, accelerating your growth. Why wait? Start now!

Choosing the Right Stocks for Smart Investing

Picking the right stocks is like planting the right seeds in a garden. Some will bloom beautifully, while others may not. That’s why it’s crucial to make informed decisions.

What to Consider Before Investing:

- Look at a company’s performance: Check its financial reports and growth.

- Consider the industry: Invest in sectors with long-term potential.

- Keep an eye on market trends: Understand the bigger picture.

- Diversify your portfolio: Don’t put all your money in one stock.

Having a well-diversified portfolio can reduce risk and improve your chances of success.

Stock Market vs. Traditional Savings: Why Investing is Better

Many people still park their savings in banks, earning minimal interest. While saving is important, investing in the stock market lets your money grow faster.

| Factor | Stock Market | Bank Savings |

| Returns | High (8-15% annually) | Low (3-5% annually) |

| Risk | Moderate to High | Low |

| Liquidity | High | High |

| Inflation Protection | Yes | No |

You should make your money work for you, not just let it sit idle in a savings account.

The Emotional Rollercoaster of Stock Market Investing for Beginners

Stock markets can be unpredictable. But remember, even the most successful investors have faced their fair share of ups and downs. Take Warren Buffett, for example. In his early years, he saw market crashes and even watched his portfolio drop by 50%. But instead of panicking, he stayed patient and calm. His long-term vision helped him become one of the wealthiest people in the world.

Tips for Staying Emotionally Strong:

- Avoid panic selling.

- Think long-term, not just about short-term gains.

- Keep learning and adapting to market changes.

- Consider using SIPs (Systematic Investment Plans) for steady growth.

Patience and resilience are key to being a successful investor. When the going gets tough, remember why you started and stay focused on the long-term goal.

Your Final Goal: Achieving Financial Freedom

Financial freedom isn’t just about having a lot of money; it’s about having choices. Whether it’s retiring early, traveling the world, or spending more time with your loved ones without worrying about money, financial independence allows you to live life on your terms.

How to Achieve Financial Freedom:

- Invest consistently.

- Reinvest your earnings.

- Diversify your investments.

- Be disciplined and patient.

Your journey in the stock market can change your life. The sooner you begin, the closer you get to financial independence. It’s never too late to start!

Take Action Now!

💡 Start your investment journey today! Learn, research, and take small steps toward financial freedom. Don’t wait—your future begins now! 🚀

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Always conduct your own research or consult with a qualified financial advisor before making any investment decisions.